|

|

|

|

|

|

|

Contents |

Occasionally, calculation errors occur on checks and they need to be corrected. The Manual Check process is used to correct these errors and update payroll and budgetary records.

Note: This application is used for record keeping purposes only. No actual check is printed with Manual Check.

Items that may be adjusted with Manual Check include:

Gross Amounts

Taxable Grosses

Deduction Amounts

Benefit Amounts

It is important to follow these steps before using Manual Check:

Make sure that no other payrolls are currently being run. Manual Check and Void Check processes will not run while a payroll process is running.

If the check is being reissued, remember to use Quick Void or Void Check to void the original check(s).

There are six steps to the Manual Check Process:

I. SElect.

Click Human Resources.

Click PAyroll.

Click Manual Chk.

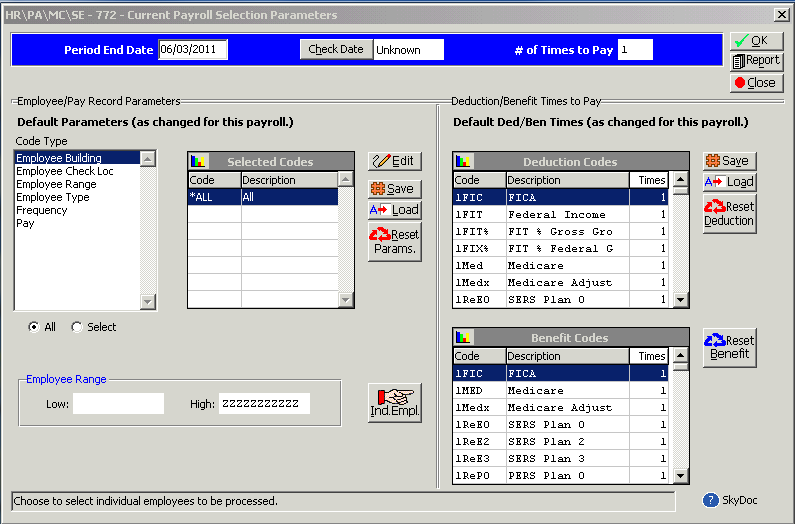

Click SElect, which opens the Payroll Selection Parameters screen.

Select the desired parameters and Click OK.

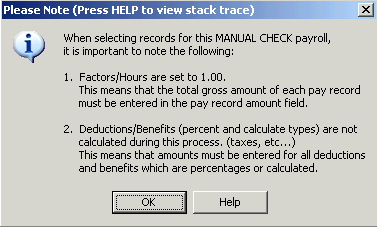

Click OK, to close the Note box.

Click the Indiv. Select box and select the employee.

Select the active Pay Record and click the Chg/Sel box.

Enter Pay, Deductions and Benefits information.

Click OK.

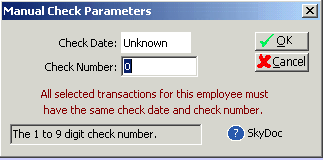

Enter a Check Number in the pop-up Manual Check Parameters box and click OK, then click Close.

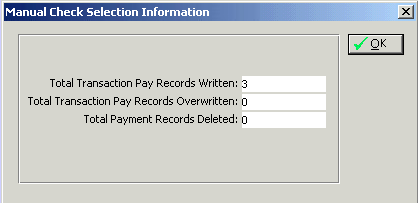

Click OK to close the pop-up Manual Check Selection Information box showing the record totals, then click Close to close the selection screen.

II. Process: Pre-Verify.

If desired, select a Pre-Calc Verification Report to run and click Close when done.

Check one of the following reports:

Employees Not Being Paid (Missing from Payroll)

Omitted Deductions/Benefits

Current Payroll Audit

Current Payroll vs. Historical Payroll Audit

Project/Grant Report

Run Individual Reports for Pay/Deduction/Benefit Totals

Click CLOSE after making your selection.

Select from additional parameters and print options and create the report.

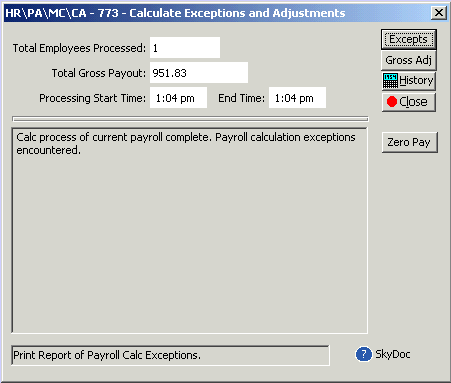

III. CAlculate manual check(s).

Click OK to process the selected checks.

Enter the desired Processing Parameters.

Click OK to accept parameters.

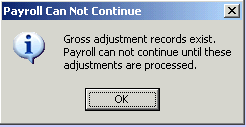

The pop-up message "Payroll Can Not Continue" appears when the process is finished and verification of Gross Adjustments is needed.

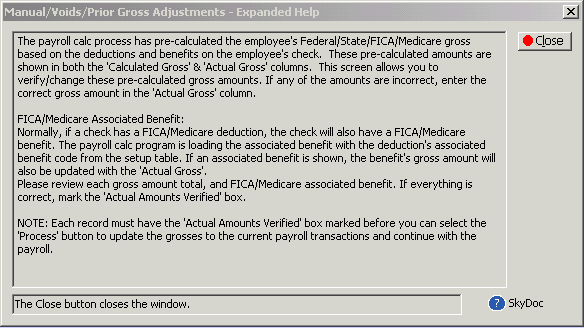

Additional help is available on the Gross Adjustments screen.

Check Actual Amounts Verified and click Close, and then click Process.

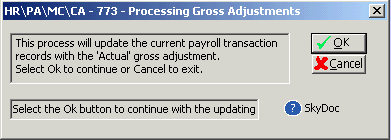

Click OK to Process Gross Adjustments.

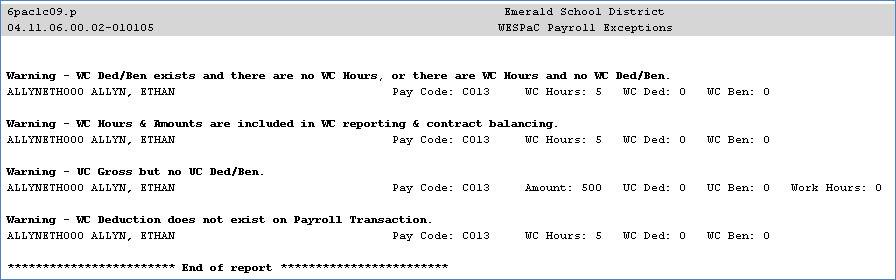

If Warning messages are generated by the Process, the Excepts button will become enabled. Click Excepts to see the WESPaC Payroll Exceptions report.

For Warning messages and associated Suggestions, see Skydoc:

WASHINGTON SCH INFO PROC COOP \ 00 – WSIPC Educational Materials\

FM – WESPaC Finance\Human Resources\ Payroll\Utilities\HR Messages\

New HR Messages Enhanced Spreadsheet

IV. Post vErify: Select from a variety of post-calculation verification reports.

Check one of the following reports:

Check Summary (Gross and Net Amounts)

Check Summary (Net Amounts Only)

Employees Not Being Paid (Missing from Payroll, with option to print Social Security number on report)

Omitted Deductions/Benefits

Labor/Benefit Distribution Report

Summary Totals for Pay/Deduction/Benefit Codes

Account Breakdown for Deduction/Benefit Codes (with option to print Social Security number on report)

Direct Deposit Report (Lists Non-Ach Deposits)

Check Verification Register (Showing pay detail, deduction/benefit totals)

Run Individual Reports for Pay/Deduction/Benefit Totals

Click CLOSE after making your selection.

Select from additional parameters and print options and create the report.

V. Chk Regstr: Create check register reports.

Click OK to get the Process Check Register screen.

Click Run to run the Check Register report set.

HINT: Select Save Report to run all of the reports at once, and then review the results in the Saved Rpts area (HR\SR).

The message "Check Register Processing is complete" appears when the process is finished.

VI. UPdate: Update salaries, benefits, and deductions to your budgetary and payroll files.

Click Run to process the payroll update.

The Updates Processed display shows which programs have been updated, with the start and end times.

The message "Payroll update is complete" appears when the process is finished.

Page Updated 11/2011